Introduction

“Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model.” - Satoshi Nakamoto

While Bitcoin narratives have shifted significantly over the years from peer-to-peer cash to darknet currency to digital gold, finance has arguably been a core part of Bitcoin and the crypto space since its early days. In its 12 years Bitcoin has progressed remarkably, but its use-cases have been limited mostly to trading and investing. Following the ethos of Bitcoin, an ecosystem of decentralized finance (DeFi) applications has emerged on the Ethereum blockchain. A few of these applications have been around since 2017, but it was not until 2020 that the DeFi space really materialized and took a shot at offering financial services without the need for trusted third parties at scale.

These DeFi applications are organized as protocols, or blockchain-based software where rules are set in code and decision-making is typically left up to network participants and token holders. Protocols are tackling use cases such as lending/borrowing, trading, asset management, derivatives and insurance. They share the common traits of being permissionless, trustless, global and composable.

Their permissionless nature means anyone around the world can access services from these protocols regardless of their background or credit score as long as they have access to the internet. These protocols are trustless as they do not rely on central third parties or intermediaries, instead delegating the trust to systems of smart contracts which anyone can review and audit. Finally, these two traits allow DeFi to be composable: any protocol is able to freely integrate with and build on top of existing solutions. This accelerates protocols’ time to market and allows cross-protocol interaction unlike anything in the existing financial industry.

Throughout this report, readers will dive deep into the expanding universe of DeFi. It will provide a holistic overview of the DeFi space and key metrics to track, an analysis of two of the sectors within DeFi thriving the most, and finally explore the relationship between these protocols and the underlying Ethereum network as it prepares for the initial phase of the so-called ETH 2.0 upgrade.

Key Metrics on DeFi’s Growth

2020 has been DeFi’s breakout year. Key metrics have increased 10-20x, while token prices experienced similar outcomes. This has led to notable figures in tech commenting on it such as Facebook's Head of Finance David Marcus and AngelList’s Naval Ravikant.

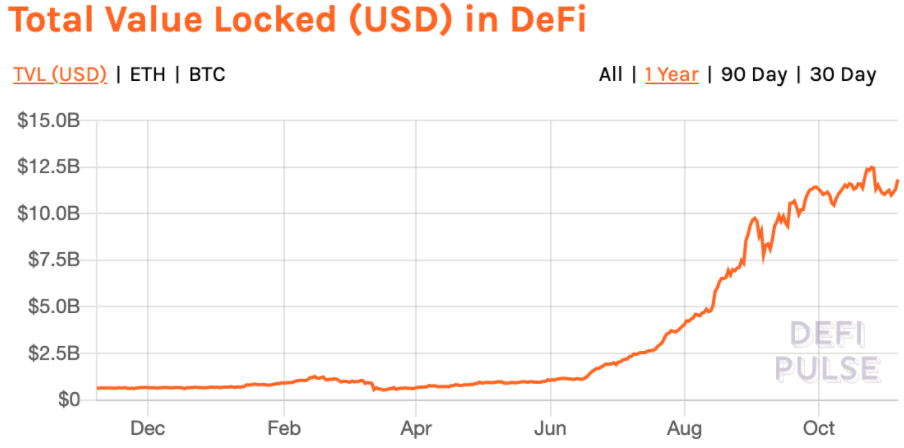

When it comes down to the indicators following the space, the most widely used is Total Value Locked (TVL). TVL refers to the total dollar amount deposited into smart contracts held as liquidity powering these DeFi protocols. It measures supply-side participation and trust from users in DeFi. In 2020 alone TVL has increased by over 17x, from $650 million to over $11.8 billion.

Source: DeFi Pulse

While TVL has quickly become the DeFi community’s barometer for the space, it does have its drawbacks. For one, it only accounts for the supply-side of the equation. In fact, it actually even subtracts demand numbers in the case of lending platforms, where their TVL is the amount supplied minus the loans borrowed from the protocol. Another criticism is that people often use it as a proxy for DeFi adoption when in reality value locked can grow regardless of the number of users supplying liquidity. That being said, it has largely been used as it is a unifying metric that applies to all DeFi protocols regardless of their sector or use-case. More pertinent metrics will be discussed for each sector in the following sections of the report.

In the TVL graph above, readers may have spotted that growth started going parabolic in the summer months. This point of inflection can be narrowed down to the launch of the Compound’s governance token, COMP, on June 15. The COMP token release was unlike most before it because it was distributed to users who were creating value to the protocol. Being a lending protocol, Compound is a money market through which users are able to obtain loans and earn interests. Compound Labs - the company behind the protocol - decided to decentralize itself and reward users with ownership of the platform through its COMP token. As such, the token was (and still is) distributed to users making loans or depositing liquidity to the protocol. These tokens grant decision-making rights, which is why they are known as governance tokens.

The impact of the COMP release was substantial: value locked in Compound jumped from under $100 million to over $600 million within a week. The distribution of tokens to users supplying liquidity became known as yield farming (or more properly, liquidity mining). Though Compound was not the first to utilize this method of ownership distribution, the release of COMP acted as the catalyst igniting a wave of new and existing DeFi protocols to launch their own tokens through yield farming.

While users certainly welcome receivinng rewards in return for using a protocol, yield farming has much broader implications. Granting ownership to users gives them “skin in the game” and directly rewards them for the value they create, unlike current technology incumbents where the value is extracted by the companies hosting the platforms. This trend, which some have begun to refer to as the ownership economy, takes DeFi one step further not only allowing users to access financial services without the need to trust a third party, but also making them owners of the platforms they add value to. Beyond providing liquidity, this distribution scheme is also being redesigned and experimented with as ways to incentivize developer activity in UMA and even to reward artists in music streaming platform Audius.

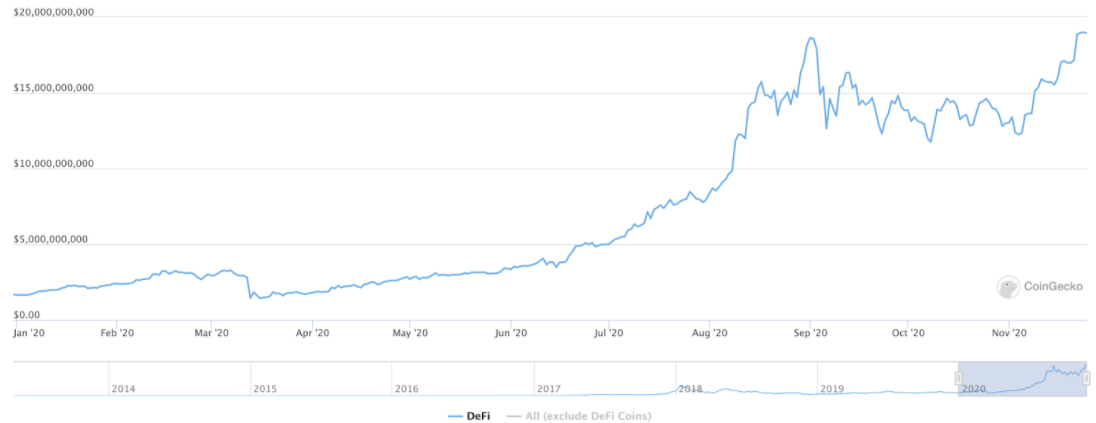

The growth in value locked as a result of the yield farming frenzy also reflected in token prices. In 2020 the market capitalization of DeFi tokens reached over $18 billion during August. While DeFi tokens experienced a severe correction in September and October, they have since recovered in November.

Source: IntoTheBlock

The reasoning behind yield farming boosting market capitalization is two-fold. Firstly, the total number of DeFi tokens increased considerably as more protocols launched their tokens through this process. Secondly, the increase in liquidity supplied in many cases created a positive feedback loop for DeFi protocols. This starts with users supplying liquidity seeking yield farming rewards, thus growing the protocol’s value locked. By doing so, the potential value accrued by governance tokens increases, in turn incentivizing more liquidity to be supplied and so on.

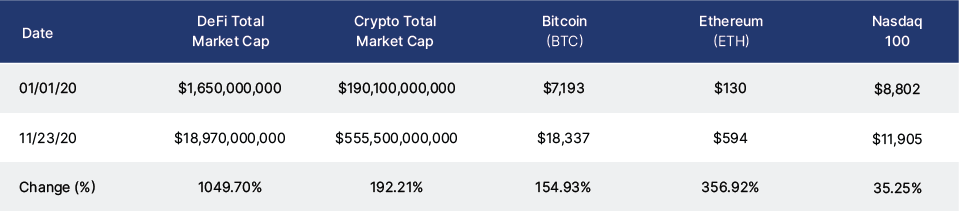

Following the release of COMP, DeFi tokens managed to appreciate by over 5x in just two and a half months before retracing approximately 40%. Despite the high volatility, DeFi tokens have managed to outperform broader crypto and technology markets. DeFi tokens’ remarkable 2020 performance is summarized in the table below:

Sources: CoinGecko, IntoTheBlock

Summary

Decentralized finance has seen substantial growth in terms of value locked and market capitalization. This trend has been accelerated by the popularization of yield farming following the COMP token release. Since then, DeFi has experienced a Cambrian explosion with the number of protocols expanding rapidly along with the Total Value Locked (TVL) and market capitalization of DeFi governance tokens.

In the following section, risks associated with investing in and interacting with DeFi protocols will be discussed. Then, key demand indicators for lending and decentralized exchanges (DEXes) will be examined.

Assessing Risks in DeFi

While DeFi’s capability to incentivize quick adoption and decentralization of its token has supercharged growth, it does not come without risks and unintended consequences. Some of the risks to consider with yield farming and DeFi in general include potential hacks, loan liquidations, unpegging of stablecoins (which tend to be used as collateral) and depreciation of the tokens received as rewards.

Smart Contract Risks

Readers may have heard of recent hacks in the DeFi space, like Harvest Finance’s exploit where an engineering error allowed attackers to withdraw $34 million worth of users’ deposits. While these hacks are not exclusive to the DeFi space, they certainly are an important risk to consider given that over $14 billion is locked in smart contracts held by the major protocols.

A silver lining emerging from this threat has been the rise of decentralized insurance protocols such as Nexus Mutual covering users against the risk of smart contract failure. DeFi users can protect themselves from the risk of hacks by insuring their positions through insurance protocols. Furthermore, demand for smart contract auditors has increased significantly as a result of the growing adoption in DeFi. It is recommended that users verify if protocols are audited or not prior to using them, though auditors cannot guarantee that protocols will not be hacked.

Further amplifying the risk of hacks is DeFi’s composability. DeFi’s permissionless nature facilitates the process to integrate with other protocols, enabling protocols to build on top of each other; a feature often referred to as “money legos”. While this composability facilitates building in the space, it could also lead to system-wide instability if one of these pieces is vulnerable to a hack. MakerDAO’s decentralized USD-pegged stablecoin DAI acts as key infrastructure for these money legos. For instance, lending protocols allow users to earn and borrow DAI. If a hacker finds a vulnerability in DAI smart contracts, users of these lending protocols risk losing their funds, possibly leading to systemic failure for protocols using the stablecoin.

Financial Risks

Tied to this risk is the unpegging of stablecoins and liquidation. As readers may know, most stablecoins are pegged 1:1 to fiat currencies, typically the US dollar. While DAI has grown within DeFi applications, the most transacted stablecoin is still Tether, which is centrally managed by the team behind BitFinex. Tether has previously been under scrutiny by many in the industry with regards to its alleged reserves backing the stablecoin. This at times has resulted in a significant disparity in its value versus the dollar. If circumstances like this arise again, there would be negative unforeseen consequences for those borrowing or lending Tether, or other stablecoins, through DeFi protocols.

For example, if you are obtaining a loan using a stablecoin as collateral and its peg drops below $1, then the loan may become undercollateralized resulting in liquidation. Conversely, if you are borrowing stablecoins and the value of the peg goes above the dollar mark, then the debt may cause you to pay more in interest than anticipated and also potentially ending up liquidated if it surpasses the amount held as collateral. This risk has been recently brought to the attention of many as the amount of DAI in Compound (cDAI) has seemingly surpassed the total amount of DAI in circulation.

Yield Farming’s Unintended Consequences

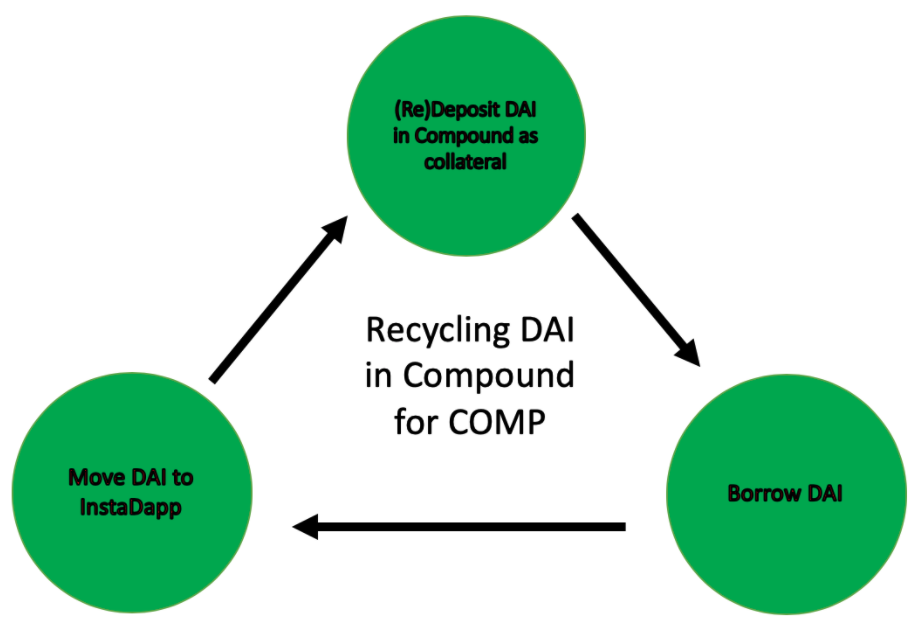

At the time of writing, cDAI’s market cap is approximately 1.7 times greater than its underlying DAI, and at one point was over eight times greater. This is an unintended consequence arising from yield farming in Compound. Since yield farmers are rewarded in highly-valued COMP tokens depending on the amount of liquidity provided, users are incentivized to provide as much as possible. In general, liquidity strengthens financial systems and is seen as a prerequisite for adoption. However, yield farming creates a perverse incentive to provide liquidity at all costs, which has led users to take advantage of this scheme by “recycling” their DAI.

Essentially, users are depositing DAI into Compound to earn interest plus COMP tokens, then they are using this DAI for an overcollateralized loan to borrow more DAI which in turn is redeposited as collateral and so forth. While this process cannot be executed directly within Compound, several users have been exploiting this loophole by transferring DAI to other DeFi protocols such as InstaDapp or simply to a separate address. A simplified diagram of this process is shown below:

This process is extremely risky as it artificially inflates the amount of DAI in Compound. Though the loans originated are initially overcollateralized, by redepositing the loaned amount as collateral to borrow more, the actual collateralization ratio drops staggeringly; leading to concerns in the community of an equivalent to fractional reserve banking taking place under the hood. In this scenario, Compound users appear to be over leveraged, putting the protocol at risk in the event that many users attempt to withdraw their DAI at once. At first glance, this risk may seem to only affect Compound and InstaDapp. However, given the aforementioned downside to DeFi’s composability, this abnormal increase in demand for DAI has become a major concern within MakerDAO’s risk team and the broader DeFi community.

Another unintended consequence arising from yield farming is that it encourages liquidity providers to act based on short-term incentives. This has led major shifts in TVL from one protocol to another as liquidity providers prove to be fickle. The best example of this was observed between the popular decentralized exchanges Uniswap and Sushiswap, which will be further discussed in the DEXes Overview section.

Finally, as is the case with agriculture, there is the risk of bad harvests. As yield farming launched this new crypto-agrarian age, “farmers” rely on quality products to profit from their endeavors. In other words, if the value of the tokens earned through these incentive systems drops significantly, users may start opting out from providing liquidity to the protocols. Similarly, the high rates of supply emission of many DeFi protocols are worth considering as the token inflation can lead to depreciation if demand does not proportionately increase.

Summary

Using and investing in DeFi protocols can be risky. The most relevant risk is that of smart contract exploits, which can lead to users losing all of their funds. For this reason, users are encouraged to interact with audited DeFi protocols and preferably those that have stood the test of time, avoiding being hacked since they launched. Additionally, users may opt to protect their capital in DeFi protocols through insurance protocols, which cover their positions if hacks do happen.

As well, there are financial risks associated with DeFi protocols. Users providing collateral to lending protocols are prone to having their positions liquidated if they do not keep healthy collateralization levels and there is market volatility. The risk of stablecoins unpegging versus the dollar also plays a role to consider when assessing if a user may get liquidated. Another financial risk to consider when providing liquidity is what is known as impermanent loss, which will be discussed in the decentralized exchanges (DEXes) section.

Additionally, while yield farming has propelled the growth in DeFi protocols, it also introduces a new set of challenges. Risks from recycled collateral and high variations in protocol liquidity are worth analyzing DeFi protocols to use. If users are intending to profit from tokens obtained through yield farming, they should also consider the rate of supply emission and whether the protocol creates incentives to hold farmed tokens.

Lending Overview

The decentralized lending/borrowing sector was the first to gain traction within the current wave of DeFi protocols. Specifically, MakerDAO kicked things off with its collateralized debt positions in 2017. These allowed users to use Ether as collateral for loans, which they would receive in terms of the DAI stablecoin. Maker loans, as with most other DeFi loans, are secured by being overcollateralized, creating incentives for users to pay back their debt to unlock their deposited ETH and providing a buffer against Ether’s price volatility. By January 2019 over $250 million in Ether collateral was already supplied by users borrowing DAI in return.

With Maker, users were able to obtain loans without the need for a trusted third party, democratizing access to credit. Compound took decentralized loans a step further by providing interest to users lending their tokens as liquidity that would then be borrowed. Compound and other lending protocols such as Aave and Cream manage to do this by redistributing the interest earned from loans to users providing the capital lent. This lending pendulum gravitates towards an equilibrium point with the following equation:

TB · IB =TS · IS, where the total amount borrowed (TB) earning interest (IB) equals the total amount supplied (TS) times the interest distributed to liquidity suppliers (IS).

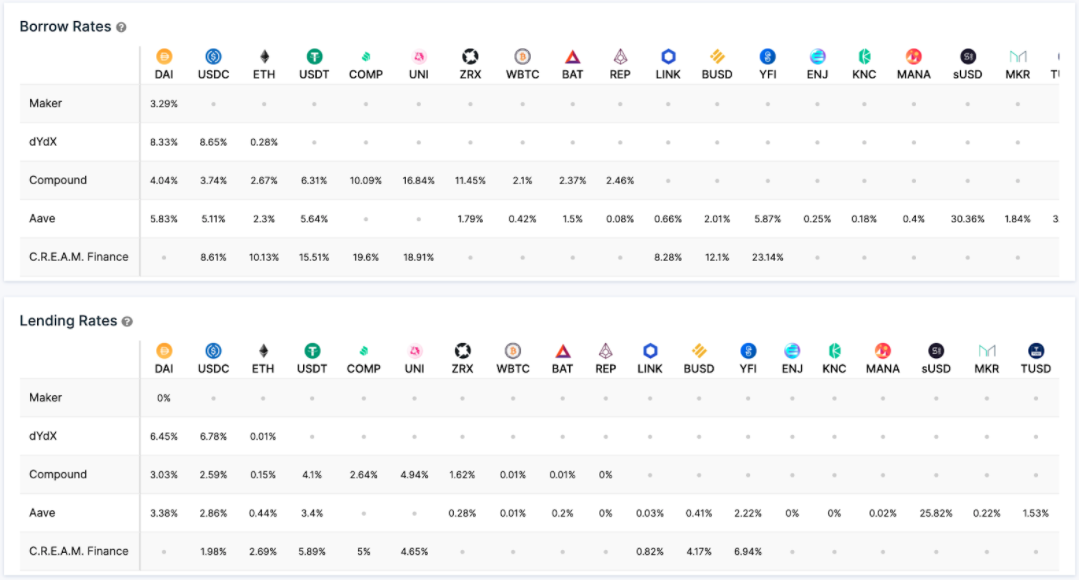

These rates are automated and adapt dynamically to market conditions. By design interest rates paid out to depositors are lower than the interest rate charged to borrowers within the same protocol. However, users can often take advantage of arbitrage opportunities across lending protocols though these may not sustain for a long period of time. For instance, based on interest rates at the time of writing, a user could borrow DAI from Maker at 3% and earn 6% interest on dYdX as shown in the image below.

Source: IntoTheBlock

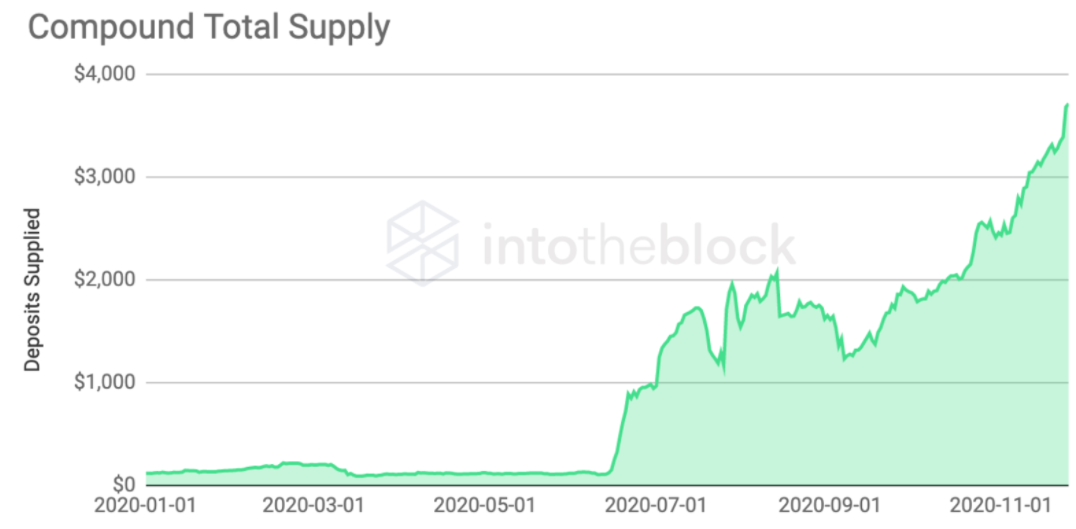

Given that these rates adjust based on the supply and demand for loans, the total amount deposited and borrowed from lending protocols reflect the health and growth of these systems. As such, the total supply lent to and borrowed from the protocol are two fundamental indicators to assess the DeFi lending sector. In the image below, readers can observe how Compound’s total supply managed to grow even during October while DeFi tokens were crashing.

Source: IntoTheBlock

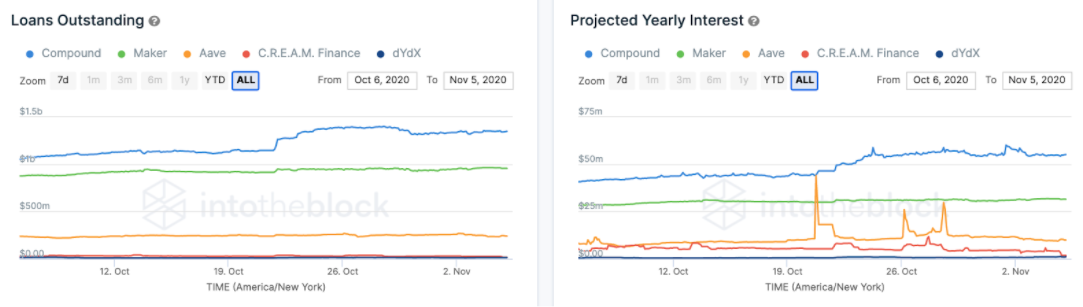

Put another way, the total amount borrowed from a protocol is what is referred to in traditional finance as the loans outstanding. This key metric measures the demand for decentralized credit. Based on the loans outstanding, the projected yearly interest can be estimated by multiplying the total amount borrowed times the weighted average interest rate charged to borrowers.

Source: IntoTheBlock

The projected yearly interest is effectively the forecasted revenue lending protocols accrue. Contrary to traditional banks, though, lending protocols nor their founders extract value from this revenue, which is fully distributed as a surplus to users supplying liquidity. Because of this model and lending protocols’ high degree of automation, users are able to enjoy interest rates on dollar-pegged stablecoins 10-20x times superior to those offered in savings accounts.

Lending protocols have emerged as some of the leading providers of decentralized financial services. Their staggering growth has reflected in their high token valuations, with three of the top ten DeFi protocols being lending ones (more than any other sector) at the time of writing. Moreover, this growth has been largely beneficial to users, who have been rewarded with high interest yields and in many cases governance rights over these platforms.

Summary

Decentralized lending platforms provide universal access to credit and high saving interest rates. Loans in protocols such as Aave and Compound are overcollateralized, requiring users to deposit more into the protocol than the amount they withdraw. This creates incentives for users to repay their debt without requiring any credit checks or documentation. Though it is not discussed in this report, there is also progress being made towards offering undercollateralized loans in DeFi.

Lending and borrowing rates operate in a dynamic, autonomous manner, adapting based on demand and supply. The major difference with traditional lending is that all the rates charged to borrowers are redistributed to those providing liquidity without any intermediaries, resulting in significantly higher saving rates of 3% to 10%. To track progress and adoption in lending protocols readers are encouraged to monitor key metrics such as the total amount of liquidity supplied, the loans outstanding and projected yearly interest.

DEXes Overview

Given crypto’s speculative nature, trading exchanges emerged as one of the first decentralized financial applications. Prior to Ethereum, projects such as Waves and Bitshares attempted to build decentralized exchanges (DEXes) on their own blockchains. These did not manage to reach a significant amount of adoption and neither did the first DEXes on Ethereum. The first generation of Ethereum-based DEXes attempted to adapt centralized exchanges and order books without significant alterations other than working in a peer-to-peer manner. This resulted in a slow and costly trading experience for users, sometimes waiting days for market orders to execute.

Inspired by a post from Vitalik on reddit, Hayden Adams founded Uniswap, an automated market maker (AMM). AMMs are a type of decentralized exchange in which order books are removed and instead rely on programmatic placement of bid and ask orders using liquidity provided by users. In other words, AMMs have users participate as liquidity providers, and the liquidity provided is allocated to offering orders for market participants looking to trade. Liquidity is supplied to trading pairs, which are rebalanced with the following simple equation:

x · y = k , where x represents the liquidity supplied for the first asset in the pair, y is the liquidity for the second asset and k is known as the k constant. Both assets x and y are rebalanced based on their price and liquidity variations such that the value for k remains the same for the total amount of liquidity and split 50/50 between both assets in the pool.

In turn for providing liquidity, liquidity providers (LPs) receive a share of the volume traded in these pairs, which in Uniswap’s case represents a 0.3% fee of the volume traded. This redesigned DEX model managed to incentivize greater liquidity and grow volumes along with it. One downside to this model, though, is impermanent loss. Impermanent loss results from the rebalancing of liquidity in a pool, where liquidity from the leading token will be swapped for that of the lagging token. This often results in lower valuation for the total amount provided though trading fees may offset this, and at times even generate an impermanent gain. Users looking to supply liquidity should consider this prior to providing liquidity and can try IntoTheBlock’s impermanent loss/ROI calculator to determine if it's worth it.

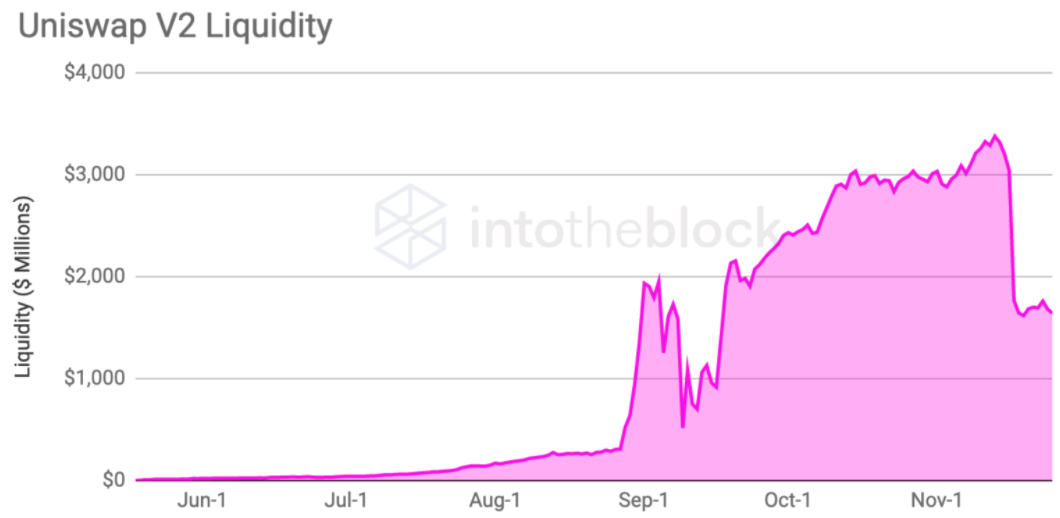

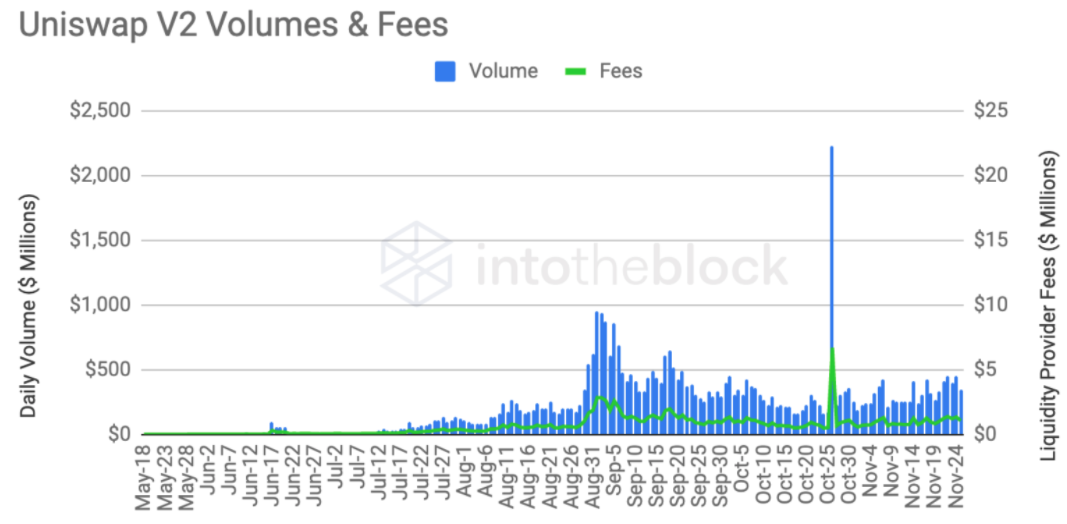

DEXes permissionless approach allowed anyone to list their tokens, expanding liquidity to the long tail of assets built on Ethereum. These factors spearheaded Uniswap’s stellar growth in 2020, even surpassing large centralized exchanges in monthly volumes for the first time. Both weekly volume traded and liquidity provided on Uniswap have increased by over 50x in 2020. This growth was accelerated by the release of the UNI token, which had 15% of its supply rewarded to previous liquidity providers and traders. Following the yield farming playbook, liquidity providers of four select pools were able to earn UNI tokens, granting them governance rights over the protocol. UNI liquidity mining has since come to an end though there are discussions in Uniswap’s governance portal to bring them back. Shortly after the yield farming program came to an end on November 17, Uniswap’s liquidity dropped by nearly 50%.

Source: IntoTheBlock

Volume and liquidity have diverged significantly since the finalization of the UNI liquidity mining rewards. Volume has remained relatively stable and even increased slightly as tokens rally in late November. This divergence showcases that while liquidity providers may be driven by short-term incentives, traders are less likely to switch even though they would likely incur lower slippages in more liquid pairs in other DEXes. This in turn, incentivizes liquidity providers to return as the fees they earn are proportionate to the volume traded.

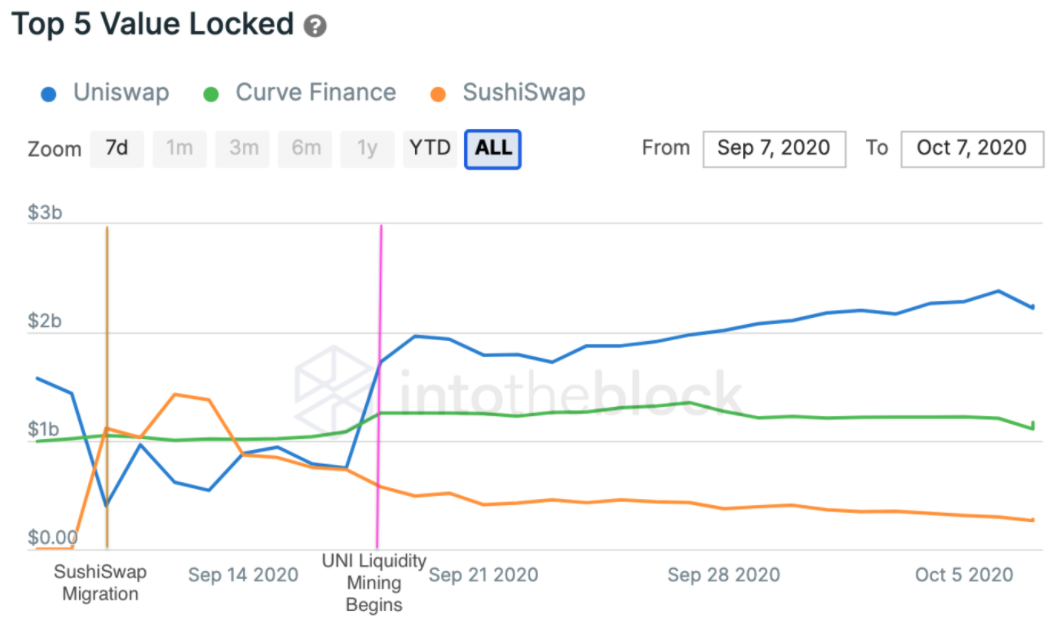

It has not always been a straight path for the top decentralized exchange. Aside from the recent drop in liquidity, Uniswap experienced the downside of blockchain’s transparency as its code was forked, or copied, by SushiSwap. Anonymous developer(s) behind SushiSwap decided to run their own yield farming scheme and entice Uniswap liquidity providers prior to the announcement of the UNI token.

Source: IntoTheBlock

The image above displays the unfolding of what is commonly referred to as the SushiSwap Saga within the crypto community. Essentially, as SushiSwap launched liquidity from Uniswap pools that would be earning SUSHI (their governance token) migrated to the forked protocol, draining 70% of Uniswap’s liquidity. SushiSwap later had a series of peculiar incidents that caused the protocol's liquidity to drop. This trend accelerated after the announcement of UNI liquidity mining, after which Uniswap began another uptrend to all-time highs in terms of liquidity supplied.

Summary

Overall, this illustrates how dynamic and fast-paced things in the DeFi space have been in 2020. At the time of writing, UNI is the governance token with the highest market capitalization, and Uniswap has the highest trading volumes and liquidity supplied out of all decentralized exchanges. While SushiSwap and other DEXes saw a short-term boost in liquidity and volume, they still make up a small portion of the total market.

While many doubted decentralized exchanges could ever match their centralized counterparts, Uniswap has proven to be a strong contender for trading volumes. Leveraging an automated market maker (AMM) design, both liquidity providers and traders are able to profit from trading in a decentralized way. Uniswap has consolidated as the leading DEX, though it has not been a straight path for the original AMM. As crypto evolves, it will be seen if AMMs continue to be the leading decentralized exchange design, or if users revert back to a variation of order books or something completely new.

Other Notable DeFi Sectors & Protocols

Other than lending/borrowing and trading, many more financial services are being decentralized on top of Ethereum. Decentralized takes on traditional industries like insurance and derivatives are currently available in DeFi with protocols like Nexus Mutual and Synthetix respectively. Nexus and Synthetix are both leaders of their sectors with $105 million and $820 million in value locked, respectively as per DeFi Pulse. Other protocols within insurance include Cover protocol, and it is worth highlighting that Nexus Mutual underwrote an insurance portal for Yearn Finance. In regards to other derivatives protocols, UMA is another large contender, though it does not have a derivatives platform of its own but rather serves as a layer for other protocols to build derivatives contracts on top of it. Other notable derivatives protocols include Hegic, MCDex and Opyn.

Moreover, new sectors have emerged such as yield farming aggregators, which automate the process of claiming rewards with cost-efficient yield-generating strategies for its depositors. Yearn Finance is the leading protocol and first one in this sector. Yearn is also notorious for its fair launch, where all tokens were distributed among liquidity providers without a pre-mine or rewards for its founder, Andre Cronje. This sparked a wave of fair launch protocols both within the yield farming aggregator sector and outside of it.

Another sector that has grown in relevance in 2020 is prediction markets. Prediction markets are an application of the concept of wisdom of the crowd, through which the collective opinion of a group of individuals is expected to be a better predictor than any single expert. In prediction markets such as Augur, users supply liquidity and select an outcome for a future event such as a sports match. Based on the positioning of liquidity providers, pay-outs and odds adjust, providing indication of the projected outcome. Prediction market protocols saw a high influx of volumes as users betted on the outcome of the US elections.

It is worth noting that even though some websites consider oracles as being part of DeFi, IntoTheBlock excludes them as their services are broader. Oracle protocols such as Chainlink and Band provide a bridge for real-world data to the blockchain, but this data is not necessarily financial.

Summary

This report only covers lending and decentralized exchanges protocols in-depth, but there are a myriad of other verticals being worked on within DeFi. Traditional sectors such as insurance and derivatives are being rebuilt from scratch, while completely crypto-native use-cases emerge. The rapid growth of DeFi suggests that more sectors are likely to emerge as existing ones continue to expand.

The Road Ahead for DeFi on Ethereum

As is the case with Bitcoin, finance has been a large part of Ethereum since its early days. In 2016 and 2017, the main financial use-case for Ethereum was fundraising. A slew of projects, sometimes with just a whitepaper and a website, rushed to raise funds through Ethereum initial coin offerings (ICOs) where virtually anyone around the world could participate. While most ICOs did not amount to anything significant, they served as the testbed for decentralized financial services.

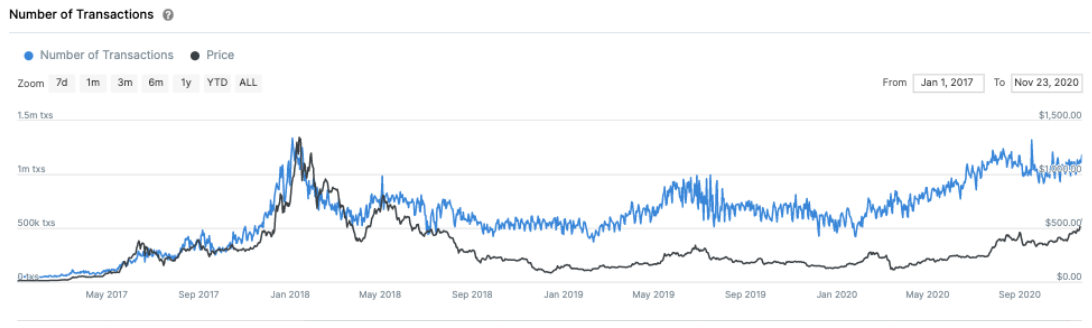

Since then, the DeFi ecosystem has grown exponentially, as protocols started shipping products that actually generate value to their users, as well as to the underlying Ethereum network. As such, DeFi protocols and Ethereum have been able to benefit from each other in a symbiotic way. Protocols have been able to build novel systems leveraging Ethereum smart contracts, which enable them to quickly deploy and integrate financial services. By doing so, Ethereum has seen an increase in demand for ETH transactions throughout 2020.

Ethereum on-chain data available at Bitstamp Insights. For on-chain deep dives go to IntoTheBlock

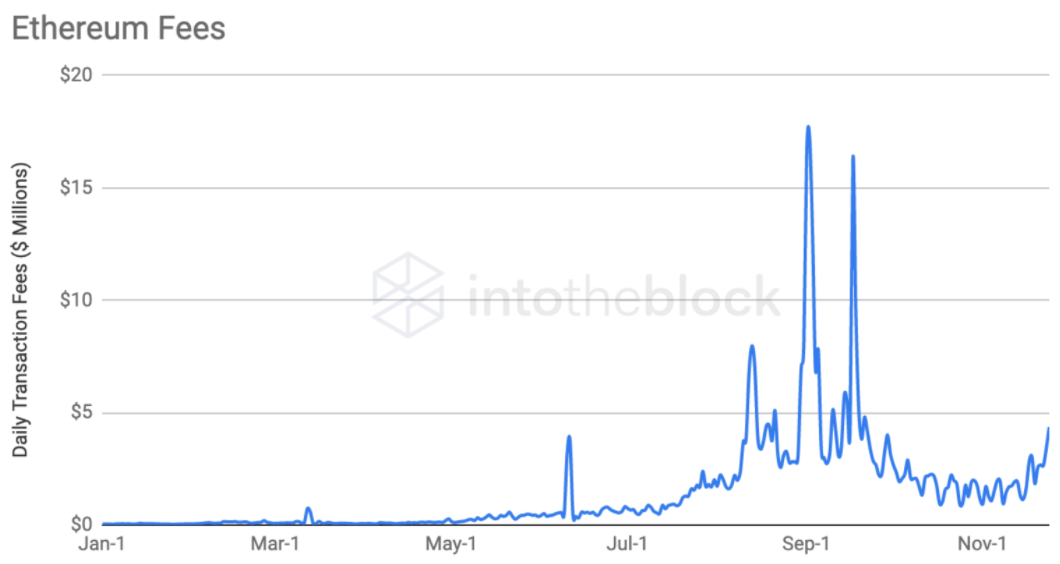

With the growing demand for Ethereum-based protocols, Ether transactions reached their highest levels since January 2018. Additionally, gas prices charged for users transacting on the Ethereum blockchain sustained unprecedented levels, especially during the summer months. This coincided with the increasing usage of DeFi protocols, through which users were able to obtain projected returns of over 20% (sometimes even above 100%) simply by providing liquidity to yield farming programs. Given the high returns, users were willing to spend high amounts on gas, bringing the fees generated by the Ethereum blockchain to all-time highs.

Source: IntoTheBlock

With over $17 million in fees on September 2nd, Ethereum eclipsed its previous all-time high of $4.7 million recorded in January 2018. Throughout 2020 Ethereum also surpassed Bitcoin as the blockchain generating the most fees. This points to the high demand to transact on top of the Ethereum blockchain, with Uniswap consistently being the protocol accruing the most fees.

While high fees have been welcomed by Ethereum miners, users suffered the consequences as gas costs priced out those seeking to make small transactions. This is being addressed by the many layer 1 and layer 2 solutions being built on top of Ethereum. On the other hand, Ethereum has also benefited from the rise of DeFi with Ether being one of the main types of collateral used to supply liquidity to protocols.

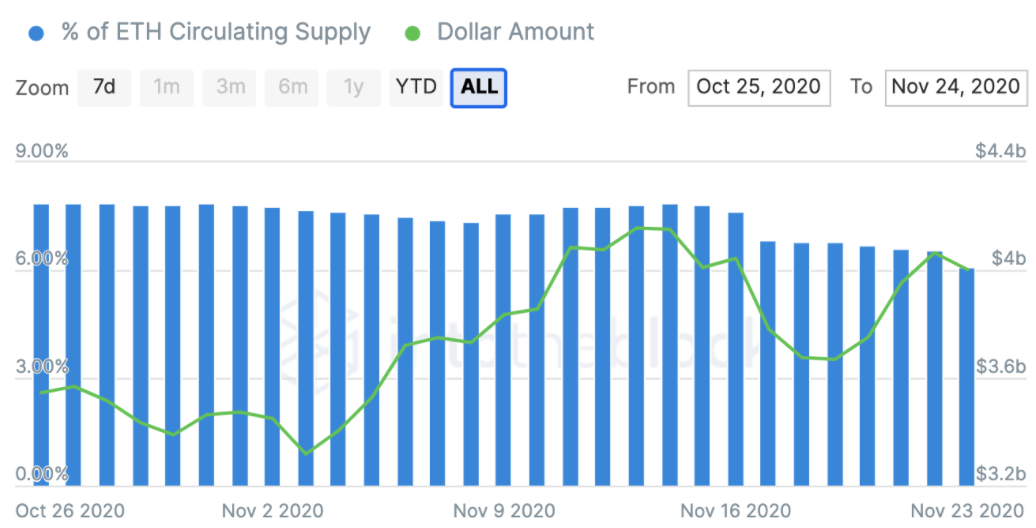

Source: IntoTheBlock, DefiPulse

While the DeFi space has seen remarkable growth, its success has largely been limited to the existing Ethereum community. In order to further expand into broader adoption, it is necessary for Ethereum to scale and remove points of friction. With ETH 2.0 phase 0 approaching, scaling is showing promises of reducing costs, which historically is a key precedent for a technology to reach mass adoption. Similarly, there are solutions being tested such as ‘gasless’ transactions that could allow users to interact with DeFi and other decentralized applications without the need for them to hold Ether or have an Ethereum wallet.

Another factor to consider is DeFi outside of Ethereum. While the report focused solely on DeFi protocols built on top of Ethereum, there are also growing ecosystems of decentralized financial applications on smart contract platforms such as Cosmos, Polkadot, Binance Smart Chain and Solana. Many of these layer one platforms have systems for interoperability with Ethereum, which potentially allows protocols to migrate or replicate in a different, more scalable blockchain. Even though these chains do not have the same network effects and community as Ethereum, it is yet to be seen whether they can foster a thriving DeFi space like the one on Ethereum.

Summary

DeFi has pushed Ethereum to its limits in 2020. With the yield farming frenzy and what is now referred to as The Summer of DeFi, transaction costs on Ethereum priced out average users. This resulted in the highest year in fees generated by the Ethereum blockchain as demand for its blockspace outpaced its transaction throughput.

Ether, the native token of the Ethereum blockchain, has also benefited from being locked as collateral in DeFi protocols. This has led to less Ether being readily available to sell, as the amount locked in DeFi increased under 3 million ETH to as much as 9 million at its peak.

With phase 0 of ETH 2.0 launching on December 1st, Ethereum is beginning its road towards a scalable decentralized blockchain. Along with this, users will be able to stake their ETH, and enjoy higher transaction throughputs once other phases of the upgrade are launched. Asides from reducing costs, there are several ideas being experimented with to decrease the learning curve and facilitate the onboarding into DeFi for users new to Ethereum. Finally, it will be interesting to keep an eye out for DeFi in other chains in 2021 to observe if they are able to consolidate and attract quality protocols and users.

About the author

Lucas Outumuro, Senior Analyst

Lucas examines crypto from a data-centric perspective at IntoTheBlock, a crypto-analytics platform. He leads research and product management efforts into new IntoTheBlock sections such as Derivatives and DeFi Insights. He also writes content for The Defiant, Deribit Insights, CoinMarketCap Blog, CryptoBriefing, Our Network and his personal Medium page. Lucas has been a speaker discussing DeFi at the Blockdown Conference and in several IntoTheBlock webinars.

Lucas graduated with a Bachelor of Commerce in Entrepreneurship from the University of British Columbia, where he worked as a Research Assistant in blockchain technology. Prior to IntoTheBlock, he had three years of startup experience in business development and ambassador roles.